I’m going to share how you can save thousands of dollars in taxes every year by simply setting your business up to be taxed as an S corp.

This is probably one of the easiest ways to save on taxes if you currently run a profitable business and have it set up as an LLC.

In fact, by spending just a few hours to do this for my business back in 2017, I’ve saved over $10,000 in taxes every year since.

That’s not life-changing money, but it’s still a solid chunk of cash, and the more my business grows, the more I save.

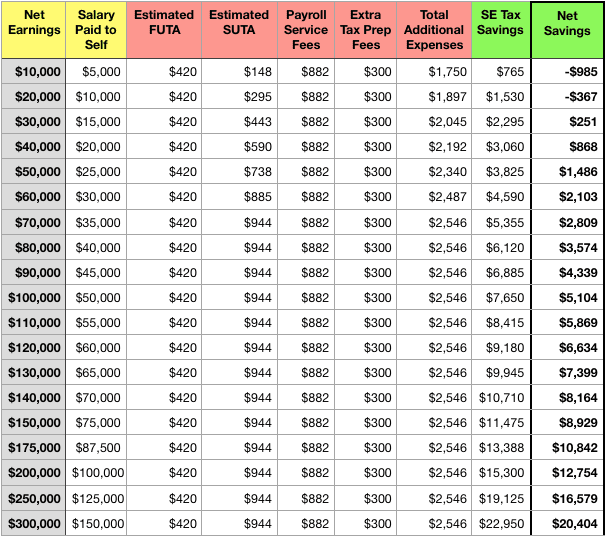

Here’s a simplified table to demonstrate how much you can expect to save by filing S Corp status based on your income.

Actual tax savings will vary depending on your state and other factors (see table at bottom of page for more details).

Disclaimer: This article is for educational purposes only. I am not a financial professional of any kind and am not qualified to give financial advice. Seek professional counsel when making important business and financial decisions.

How does filing S Corp status save on taxes?

It reduces your Self-Employment (SE Tax) taxes significantly.

Self-employment tax is currently set at 15.3%. That’s 12.4% for Social Security and 2.9% for Medicare.

Without an S Corp, you have to pay SE Tax on net income (which includes every dollar of profit your business generates for you, including your salary).

With an S corp, you only have to pay SE tax on your salary (which you get to determine).

EXAMPLE

Let’s say you are a self-employed handyman who formed your business as an LLC. You work by yourself and have no employees. This year, your business generated $150,000 in revenue, and you had $50,000 in expenses (tools, gas, insurance, materials, etc.). That means your Net Earnings were a clean $100,000, and you must pay 15.3% in SE taxes. That comes out to a whopping $15,300 in SE Tax.

$15,300 is a lot of money to pay in taxes, especially considering that you still have to pay Federal Income Tax on a good portion of what’s left over.

Now, let’s say this year you got smart (or just read this article), and decided to take a few hours to request that the IRS treat you as an S corp.

With an S corp, you will only have to pay that 15.3% SE Tax on your salary, NOT the net earnings.

Let’s say you decide that an appropriate salary for you is $50,000.

Now, let’s say that next year you make exactly the same amount that you made this year, except this time, you elected to be taxed as an S Corp.

Now, you only have to pay SE taxes on that $50K salary vs all $100K of profit. That reduces your SE taxes from $15,300 to just $7,650!

That’s $7,650 in tax savings by electing S corp status.

This is because, as an S corp, you only have to pay Self-Employment taxes on your salary. The rest is considered profit you can pay yourself through shareholder distributions (a fancy name for paying yourself SE tax-free).

Here’s that same example shown with just the numbers:

A regular LLC (No S Corp status)

Gross Revenue: $150,000

Expenses: $50,000

Salary: $50,000

Net Earnings: $150,000-$50,000 = $100,000

Self Employment Tax: $100,000 x .153 = $15,300

An LLC WITH S corp status

Gross Revenue: $150,000

Expenses: $50,000

Salary: $50,000

Profit After Paying Your Salary: $40,000 (SE Tax-free)

Self Employment Tax: $50,000 x .153 = $7,650

The Downside of Filing as an S Corp

There are a few downsides, and you must jump through a few hoops to make this happen.

Here are a few ways having an S corp makes things slightly more complicated:

- You have to deal with Payroll – This is easier than it sounds, especially once you get it set up. For my business, I hired my bookkeeper to handle my payroll. I pay her $80 per month and she cuts me a paycheck twice a month and makes sure taxes get paid.

- More detailed accounting is required. As an S corporation, there are stricter accounting rules. I’m not going to get into what they are here, but just know that your accounting is held to a higher standard by the IRS. Again, I had my bookkeeper help me make sure my accounting practices were up to par.

- You have to file quarterly payroll tax returns. My bookkeeper handles these for me as well, and the service is included in my payroll fees.

- Some states have an annual filing fee for S corps, which could cost a few hundred dollars.

- It’s more expensive to file taxes – I pay a pro to file my taxes. After switching to an S Corp, my fee went from $350 to $650 (an 85% jump).

- You have to pay Employment Taxes – There are two additional taxes you’ll have to pay: Federal Unemployment Tax and State Unemployment Tax (FUTA and SUTA). These taxes are relatively small if you are self-employed, but they are there and must be considered.

By the way, these extra taxes and expenses are already included in the simple table above and the more detailed table below.

This might seem overwhelming initially, but it’s all pretty simple as long as you have an accountant or a bookkeeper who knows what they are doing to help you. I worked closely with my bookkeeper to get it all set up, and all I paid was $150 for the initial setup.

Yes, it is boring work, but it’s often well worth the effort and only takes a few hours.

How much would you save if you elected S corp status? Is it worth it?

At this point, you’re probably wondering…Is this worth the effort? Especially considering the complexity and extra taxes you have to pay?

Well, just like everything in business, it all comes down to crunching some quick numbers, which I’ve already done for you.

In most cases, the answer is yes. It’s worth it, especially as your profits grow.

But I don’t want you to take my word for it. Take a look at the table below to help you estimate how much you could expect to save by electing S corp status for your business.

Table 1: Estimated Tax Savings By Electing S corp Status*

*The salaries listed are not necessarily representative of a reasonable salary. You, the business owner, must determine that.

Let’s examine the table above for a second.

On the left, you have your Net Earnings, which I explained above. That is your profit (including what you pay yourself).

Next, you have the “Salary Paid to Self” column, which should be self-explanatory – it’s the salary that you decide is a reasonable salary to pay yourself. Now, if you’ve been paying close attention so far, you’re probably thinking…“Hey, why don’t I just pay myself a ridiculously low salary (like say $10K per year) so I pay even less SE Tax?” Well, as you may have guessed, the government would frown upon that, and you would risk owing lots of money later in back taxes. So, you want to figure out a reasonable salary given your job description. In the table above, I just set the salary as 50% of the Net Earnings. That is not for any reason other than to create this example table.

Next in the table, you have the red columns, which are the additional taxes and expenses that you may have as a result of managing an S corp, with the furthest right red column being a total of all of these. Of course, your taxes and expenses may be lower or higher, but the table should give you a good estimation.

Then, you have the green columns. The one on the left shows how much you’ll save on self-employment taxes based on the other numbers in the table. The very right column is the Net Savings, which is how much extra money you can expect to put directly in your pocket (before federal income taxes) as a result of electing S corp status.

As you can see on the table, if you make $15,000 in profit above what you pay yourself as a salary, having an S corp will lead to a net positive. And, the higher your profits are after paying your salary, the more money you will save by electing S corp status.

A few more considerations

Unfortunately, financial decisions aren’t always that simple, so it’s a good idea to discuss this with an accountant before deciding what’s best for you.

Here are a few things you will want to consider:

- Paying less into Social Security will effect your Social Security benefits when you retire. It’s difficult to know how much, but this should be considered. Personally, I’d prefer to save the taxes and invest my additional profits myself, but everyone is different.

- You need to pay yourself a “reasonable” salary. If you drop your salary ridiculously low, you risk paying back taxes to the IRS in the case of an audit. Don’t do that.

- Tax codes are complicated. It’s impossible for me to consider every aspect of this in one article, which is why you should have an accountant evaluate your situation.

Setting up an S Corp

You don’t “set up an S corp” because it’s not technically a business entity like a C corp or an LLC is. Instead, you simply elect that your LLC or C corp be taxed as an S corp. It’s basically just a way to be taxed.

So first, you need to form your business as an LLC or a C corp. If you haven’t done that, that’s where you’ll want to start. For most handyman businesses or self-employed people, an LLC is the best choice, but you and a knowledgeable accountant should ultimately determine that. I’m not an accounting professional.

Then, you fill out a few forms for the IRS. Which forms you submit will depend on your situation. Here are the forms you’ll need if you have an LLC:

Honestly, all of this can get pretty confusing, so I strongly recommend getting help from your accountant or a knowledgeable bookkeeper. I recommend finding somebody who you will pay to manage your payroll and have them help you get set up since they will benefit financially from doing so.

Time is of the essence!

There is one more important thing to know. If you want to elect S corp status, then now is the time to do it (before the end of the year). That’s because there is a deadline at the end of the year. If you miss it, you’ll have to wait another whole year and continue overpaying in taxes.

Also, you can’t elect S corp status for the current year. It starts the year AFTER you submit your paperwork and get approved. You won’t be able to save on this year’s taxes, but if you set it up now, you can save on next year’s taxes and in future years.

And finally, if you are just starting your business and feel overwhelmed, this is something that you can put on the back burner. Don’t allow this minutia to stop your progress. You have bigger fish to fry, like simply getting started. Start by forming an LLC and tackle this problem after you start making real money.

Want More Simple Changes That Lead to Big Results?

Check out my $100K Handyman Pricing course. You’ll get in-depth videos packed with tips and tricks to boost your income, save time, and run a more enjoyable business.

These are the data points and information that were probably available to me when I started to learn the differences between corner beads in drywall installation, but to read it all like this in a well formatted blog post really puts some things in perspective for me.

This blog post also inspired a bit of a debate with my dad, who has been telling me to read up on taxes and corporate structures. I guess it always made more sense to have an accountant take care of it.

Anyway, this was a great post, Dan!

Glad you found it helpful Chris! Knowing this has certainly paid off for me.

Great post Dan!

What I was curious about was Estimated Taxes. As an LLC or Sole Proprietor, I know you have to pay quarterly taxes on your estimated income tax.

What will you do for the “pass-through” income from the business (since you won’t have to pay estimated taxes on your W-2s)?

Thanks David. I’d love to help you with this, but I’m not sure what you mean. All of the income you generate as an LLC or Sole proprietor is passed through to your personal income at the end of the year when you have a pass-through entity. You will always have to pay estimated taxes as well, they are just a bit lower when you have an S-corp because you aren’t paying 15% self employment taxes on the profit you generate after paying yourself.

Thanks for this! Once, in a previous business, I changed from LLC to S Corp and saved $5k easy in taxes that year. Great article, I need to do it for my new one -handymanmpls.com

Thanks again!

Robbie

Hi Dan..!

I have always enjoyed your posts. I would like you to post a Canadian version of this tax structure in the near future for us cousins in the north.

Many thanks

If you write it up, I’d be willing to post it on this website with a link back to yours.

Shouldnt the red column amounts be added to my LLC/S-corp company expenses?

The concept is tried and true. Please consult with a professional regarding the savings though. The tables are incorrect and did not incorporate (pun intended) that there is a wage base for social security taxes. They are capped on $142,800 (2021) and is indexed for inflation. The net savings on a net of $300K and a salary of $150K is closer to $6K .